Last Updated on 26/07/2023 by Sarah Sarsby

Earlier this month, Glynn Jones from the Bank of England gave an important presentation to British Healthcare Trades Association (BHTA) members about the UK’s economic outlook.

The talk took place at the BHTA’s inaugural joint meeting for the Children’s Equipment, Independent Living, and Mobility sections on 5 July 2023. This event ran at the Walton Hall Hotel and Spa in Warwickshire and provided insightful presentations for attendees and demonstrated the value of being a BHTA member.

One of the key presentations from the day was from Glynn with a UK economy forecast.

He explained that trade shock has negatively impacted the UK economy, including challenges around export and import. Inflationary pressures means that the UK has been poorer overall.

The most recent UK economy forecasts – from May 2023 – reveal that:

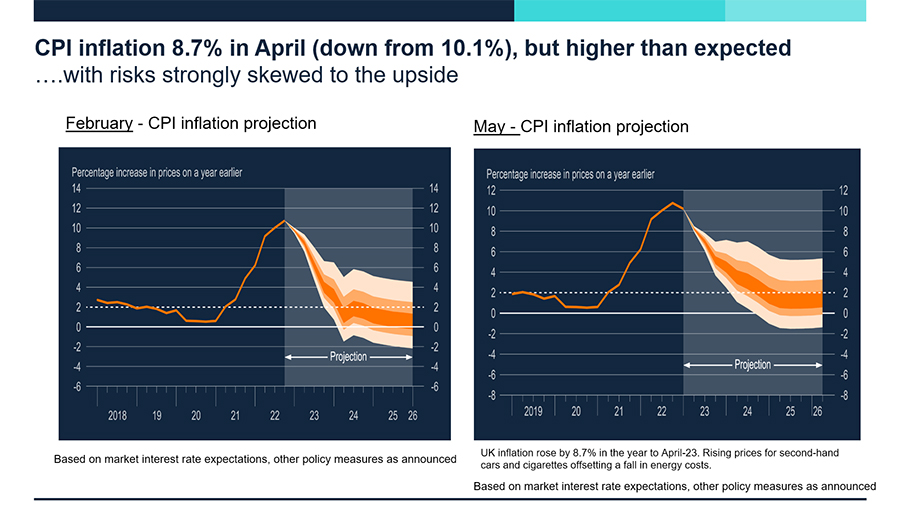

See below some interesting slides from Glynn’s presentation about Consumer Prices Index (CPI) inflation trends and forecasts.

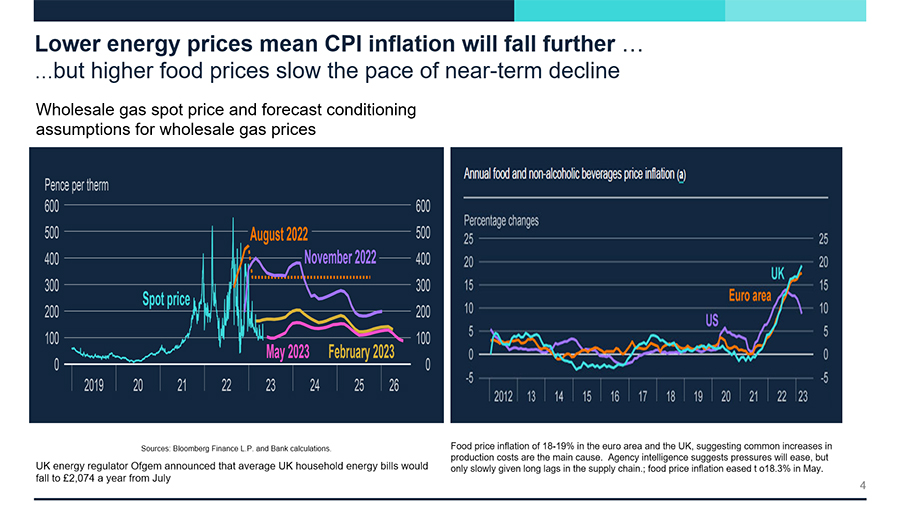

However, inflation coming down will be slower than its sharp increase. As the UK imports a lot of food and energy, this has caused major inflation. Supply-side shocks are also a big factor, added Glynn.

Additionally, wage inflation has increased. Employers, on average, are offering two to three percent pay increases. If margins have been squeezed and there are no productivity gains within firms, this all means companies have to increase their prices, he underlined.

The UK’s labour market is tight because of inactivity due to sickness and ill health, such as anxiety, long waiting lists, and mental health decline, Glynn pointed out. The upside, he continued, is that there has been growth in employment in the UK. Last year, unemployment was at the lowest it had been in 50 years.

Looking at gross domestic product (GDP) growth, the demand outlook for May 2023 is stronger than February 2023, partly owing to lower energy prices. GDP growth is positive throughout, Glynn added, rising by a quarter of a percent in 2023 and forecasted to rise by three quarters of a percent in 2024 and 2025.

In the near term, unfortunately, growth prospects within the UK remain weak. Find out more in the slide below.